Get Electronics Now.Pay Later.

Good credit? Poor credit? No credit?

Snap Finance has you covered with lease-to-own financing and loan options.

Where do you want to shop for electronics?

Apply now. Get an answer in seconds.

We look beyond your credit score, considering you for opportunities others may not.

Shop today.

Use our Store Locator to choose from 150,000+ shops, in-store or online, to get what you need today.

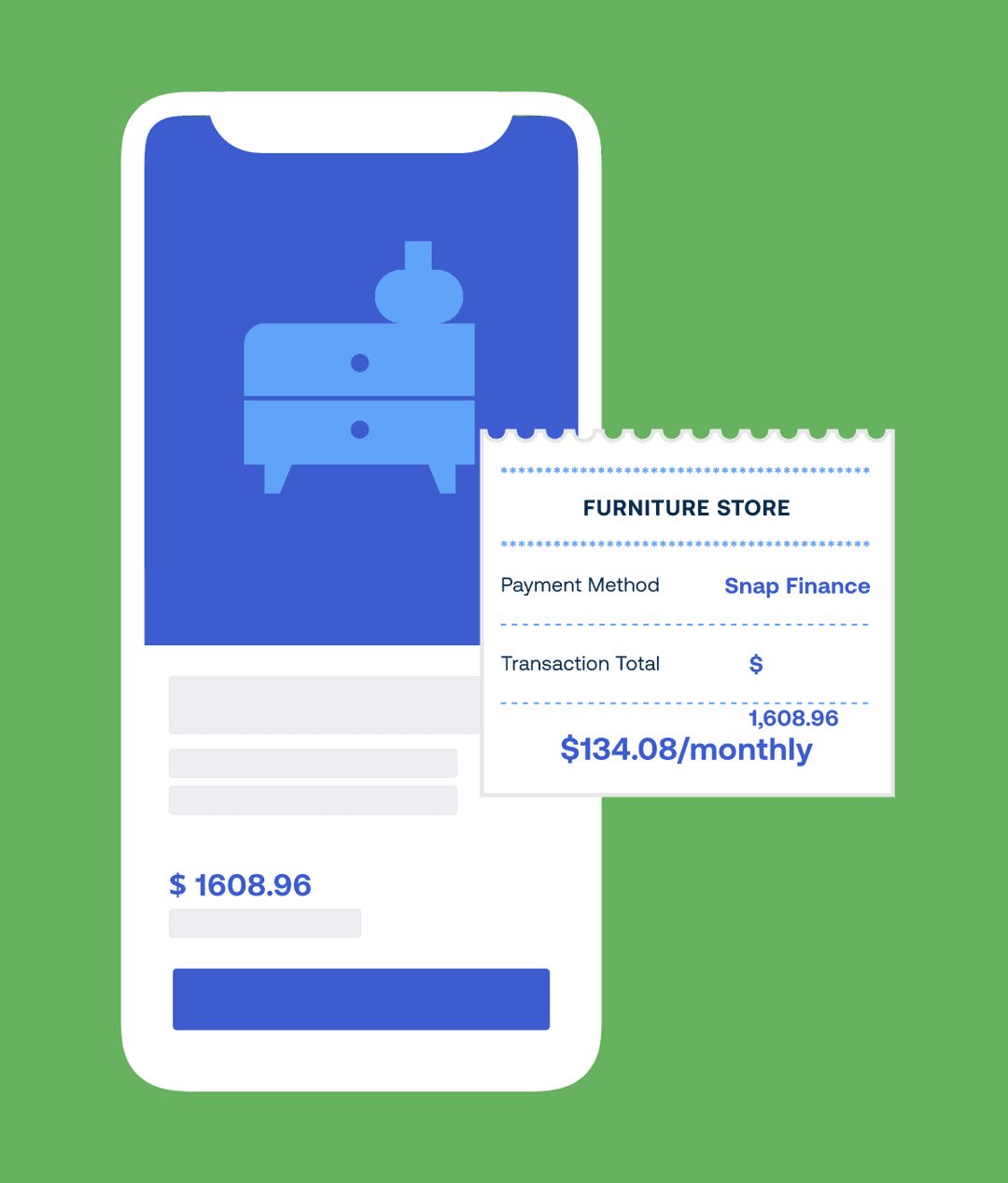

Pay over time.

Our convenient payment options are based on your paydays for an easy, stress-free experience.

Have more questions?

How to finance electronics with bad credit?

If poor credit is keeping you from qualifying for standard loans or in-store financing, Snap offers lease-to-own and loan solutions to help. Snap-branded solutions gives those with bad credit the opportunity to get what they need and pay over time. Some electronics stores offer lease-to-own or other financing options on location, but you can always apply online and get preapproved before you even start shopping. It’s easy!

With Snap, all credit types are welcome to apply. While no credit history is required, not all applicants are approved. Snap obtains information from consumer reporting agencies in connection with applications, and your score with those agencies may be affected.

Where is a good place to finance electronics?

When using lease-to-own or loans for electronics, look for a company that makes it convenient. Snap’s easy online application can be completed on your smartphone, and you’re notified of your decision in seconds. When you apply with Snap, you’re also presented with clear and simple terms before you sign your agreement.

When is a good time to finance electronics?

Generally, you’ll find deals on electronics towards the end of the year, with Black Friday and Christmas sales discounting popular electronics. Other major holidays that coincide with retail sales include Memorial Day, Independence Day, Presidents Day, and Labor Day. If you’re going to finance an electronics purchase, waiting for one of these holiday sale events events can get you the most bang for your buck.

Shop now, pay later with Snap-branded loans or lease-to-own financing.